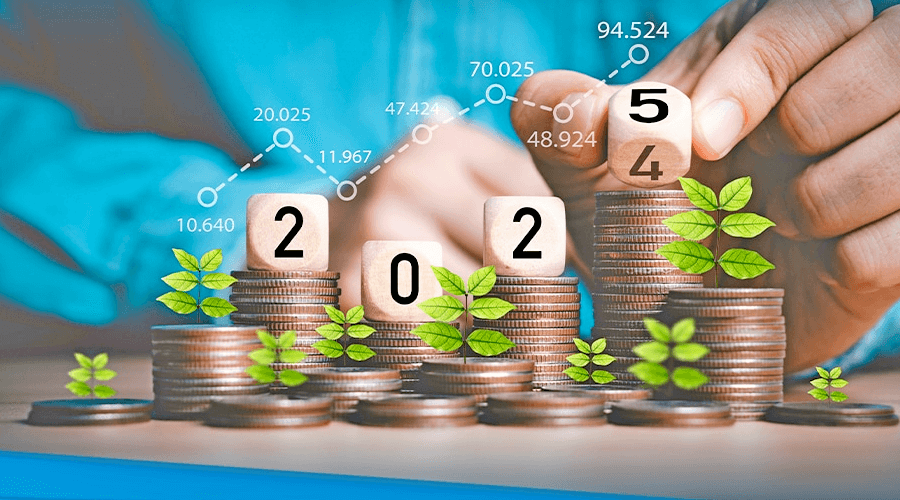

Introduction: Navigating the Investment Landscape in 2025

As we step into 2025, the investment landscape is rapidly evolving. From advancements in artificial intelligence to the rise of sustainable investing, new opportunities are shaping the way people build wealth. Whether you’re an experienced investor or just starting, understanding the top investment trends can help you maximize your returns and stay ahead in an ever-changing market.

1. Artificial Intelligence and Tech Stocks

AI is at the forefront of innovation, with companies leveraging automation, machine learning, and robotics to drive efficiency. Investors are eyeing AI-driven businesses such as Nvidia, Tesla, Google (Alphabet), and Microsoft, which continue to expand their reach in various sectors. Tech ETFs and AI-focused funds offer diversified exposure to this booming industry.

2. Cryptocurrency and Blockchain Technology

Despite volatility, cryptocurrencies continue to attract investors. Bitcoin and Ethereum remain strong, but newer projects focusing on DeFi (Decentralized Finance) and NFT-based assets are gaining traction. Blockchain technology is also driving innovations in supply chain management and digital security, making crypto-related stocks and ETFs a viable investment.

3. Sustainable and ESG Investing

Environmental, Social, and Governance (ESG) investing is growing rapidly as more companies commit to sustainability. Green energy firms, electric vehicle manufacturers, and companies prioritizing ethical practices are seeing significant inflows of capital. ETFs like iShares Global Clean Energy ETF (ICLN) and SPDR S&P 500 ESG ETF (EFIV) are great options for those looking to invest in sustainability.

4. Real Estate Investment in High-Growth Markets

With remote work trends persisting, real estate investments are shifting toward suburban areas, co-living spaces, and smart cities. Investing in REITs (Real Estate Investment Trusts) provides a way to gain exposure without direct property ownership. Look for opportunities in cities with population growth and strong economic development.

5. The Rise of High-Yield Savings Accounts and Bonds

With interest rates stabilizing, high-yield savings accounts and government bonds are becoming attractive again. Treasury bonds, municipal bonds, and corporate bonds with strong credit ratings offer low-risk investment opportunities while providing steady returns.

6. The Metaverse and Virtual Reality Investments

Tech giants like Meta (Facebook), Apple, and Nvidia are heavily investing in the metaverse. This digital space is expected to revolutionize gaming, entertainment, and even remote work. Investors can gain exposure through individual stocks or metaverse ETFs such as Roundhill Ball Metaverse ETF (META).

7. Healthcare and Biotech Innovations

Biotechnology, genetic research, and pharmaceutical breakthroughs are key areas for investors. The healthcare industry continues to evolve with personalized medicine, AI-driven diagnostics, and telehealth services. Stocks like Moderna, Pfizer, and CRISPR Therapeutics could provide high returns as medical advancements accelerate.

8. E-Commerce and Digital Payment Solutions

The e-commerce boom is not slowing down. Companies like Amazon, Shopify, and MercadoLibre are leading the way, while digital payment firms like PayPal, Square (Block), and Visa are facilitating the shift to a cashless society. Investing in these sectors ensures exposure to the ongoing digital economy expansion.

9. Passive Income Through Dividend Stocks

Dividend-paying stocks are a great way to build passive income. Companies with strong financials and consistent payouts, such as Coca-Cola, Johnson & Johnson, and Procter & Gamble, provide stability even in uncertain economic conditions. ETFs that focus on dividend growth can also diversify risk.

10. Alternative Investments: Gold, Silver, and Commodities

Precious metals like gold and silver remain safe-haven assets, especially during inflationary periods. Commodities like oil, natural gas, and agricultural products also provide a hedge against economic downturns. Investing in commodity ETFs or physical assets can help diversify your portfolio.

Final Thoughts: Where Should You Invest in 2025?

The key to smart investing in 2025 is diversification. Combining high-growth assets like AI stocks and cryptocurrencies with stable investments like dividend stocks and real estate can help balance risk and reward. As always, conduct thorough research, consult financial advisors, and stay informed about market trends to make the best investment decisions for your financial future.