An emergency fund is a financial safety net that protects you from unexpected expenses like medical emergencies, job loss, or car repairs. In 2025, with economic uncertainties on the rise, having a six-month emergency fund is more important than ever. Follow these steps to build your financial cushion quickly and efficiently.

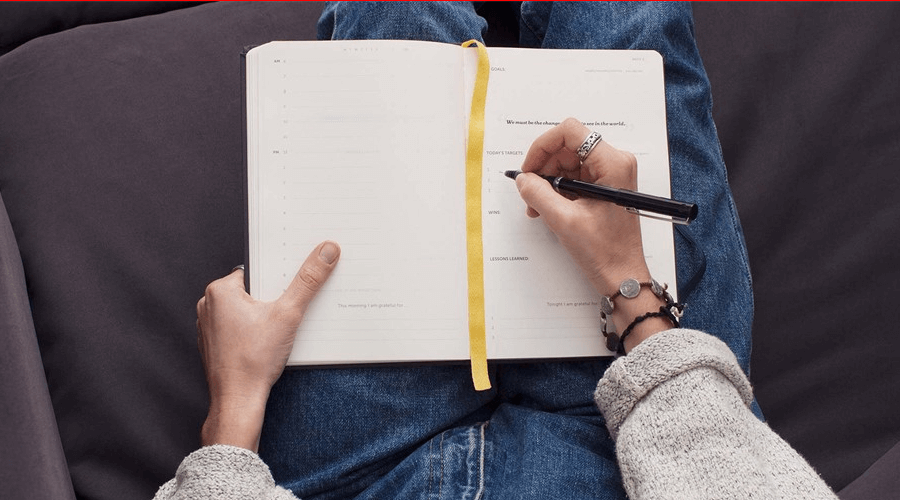

1. Set a Clear Savings Goal

Calculate your monthly essential expenses, including rent, utilities, groceries, insurance, and debt payments. Multiply this amount by six to determine your emergency fund target.

2. Automate Your Savings

Set up automatic transfers from your checking account to a high-yield savings account. This ensures you consistently contribute to your emergency fund without the temptation to spend.

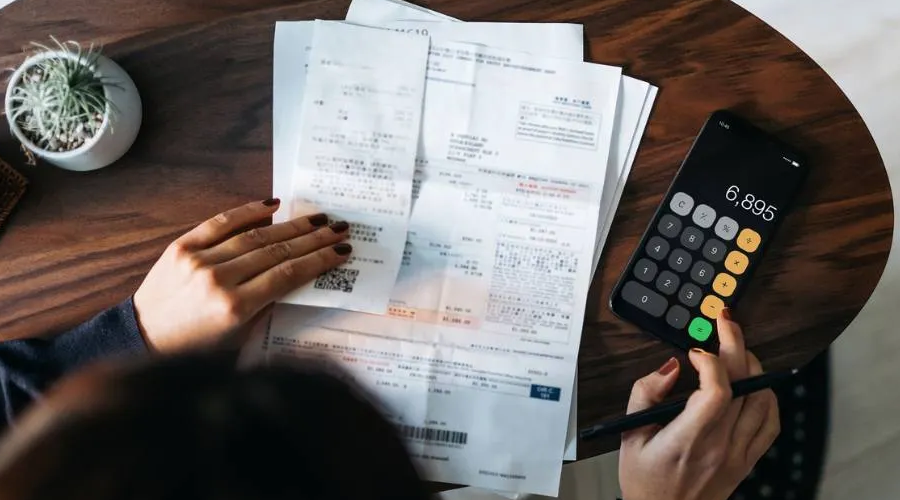

3. Cut Unnecessary Expenses

Review your spending habits and eliminate non-essential expenses like subscriptions, dining out, or impulse purchases. Redirect these savings toward your emergency fund.

4. Increase Your Income

Look for side hustles, freelance gigs, or overtime opportunities to boost your earnings. Consider selling unused items or monetizing a hobby to generate extra cash quickly.

5. Use Windfalls Wisely

If you receive a tax refund, bonus, or stimulus check, deposit it directly into your emergency fund instead of spending it on non-essential items.

6. Reduce Debt to Free Up Cash Flow

Prioritize paying off high-interest debt to minimize financial burdens and free up more money for savings.

7. Take Advantage of Cashback & Rewards

Use cashback credit cards and reward programs to save on everyday expenses and deposit those savings into your emergency fund.

8. Meal Plan & Buy in Bulk

Reduce grocery expenses by planning meals in advance and purchasing non-perishable items in bulk to save money over time.

9. Avoid Lifestyle Inflation

When you get a raise or additional income, maintain your current lifestyle and direct the extra funds toward your emergency savings.

10. Track Your Progress & Stay Motivated

Regularly review your savings progress, set milestones, and reward yourself when you reach key benchmarks to stay motivated.

Final Thoughts

Building a six-month emergency fund doesn’t have to take years. With smart budgeting, increased earnings, and disciplined saving, you can achieve financial security in record time. Start today and give yourself the peace of mind that comes with financial preparedness.